Welcome to the The "Real" Real Estate Experience aka Housing Bubble 2.0

We Are "Real" People Doing "Real" Real Estate Deals in the Real Estate Market

Where is the Real Estate Market Headed ? We Have an Affordibilty Crisis at the Moment and The Housing Market is Moving into Uncharted Territory Once Again.

Home Prices are at All Time Highs and Elevated Mortgage Rates Have Made Purchasing a House for the Average Person Unattainable. Home Price Appreciation has Far Outpaced Wage Growth Over the Years & Without Quantitative Easing (QE), the American Dream of Home Ownership Will Never Become a Reality for Many.

Find Out What's Really Going on in Your Local Housing Market So You Are Positioned to Succeed for Today in order to Build Income, Equity and Wealth for Tomorrow. Remember that Housing Market is Manipulated by the Banks, the Government and Wall Street. Become Educated so You Can Make the Best Decisions and Get Ahead of What is Going to Happen in 2026 and Beyond.

The Deals Are in Distressed Housing

It does not make sense to purchase Real Estate at the height of the market or at retail values. Yes property values have recovered and risen however appreciation has slowed down and some Metro markets are showing signs of weakening and have started to slide. So where does one find good deals ? There are many options if you do a little homework, including the one market niche with a large supply of inventory that everyone seems to have forgotten: The Foreclosure Market.

Are We in Another Housing Bubble ?

According to many Economists, Industry Analysts and other Investors, we are definitely in another Housing Bubble. In fact, we are at the end of Stage 2 of the Housing Bubble: The Peak. Many Major Metro markets across the country are now over valued and Home Buyers can't compete with higher prices and the low amount of Housing inventory. Couple that with the expected volume of Foreclosure Filigns due to the Pandemic, it does appear we have another issue at hand: Housing Bubble 2.0 .

How Do We Insulate Ourselves From the Next Crisis ?

You have probably heard the saying that "people make the most income" during a downturn, crisis or recession. This is true, provided you know how to interpret the signals and have a game plan or solid and proven system in place. This could be the last time in our lifetime that something like this occurs. Find out how to navigate through this new market dymamic, whether you are a Real Estate Investor or Retail Buyer. Never Pay Retail !

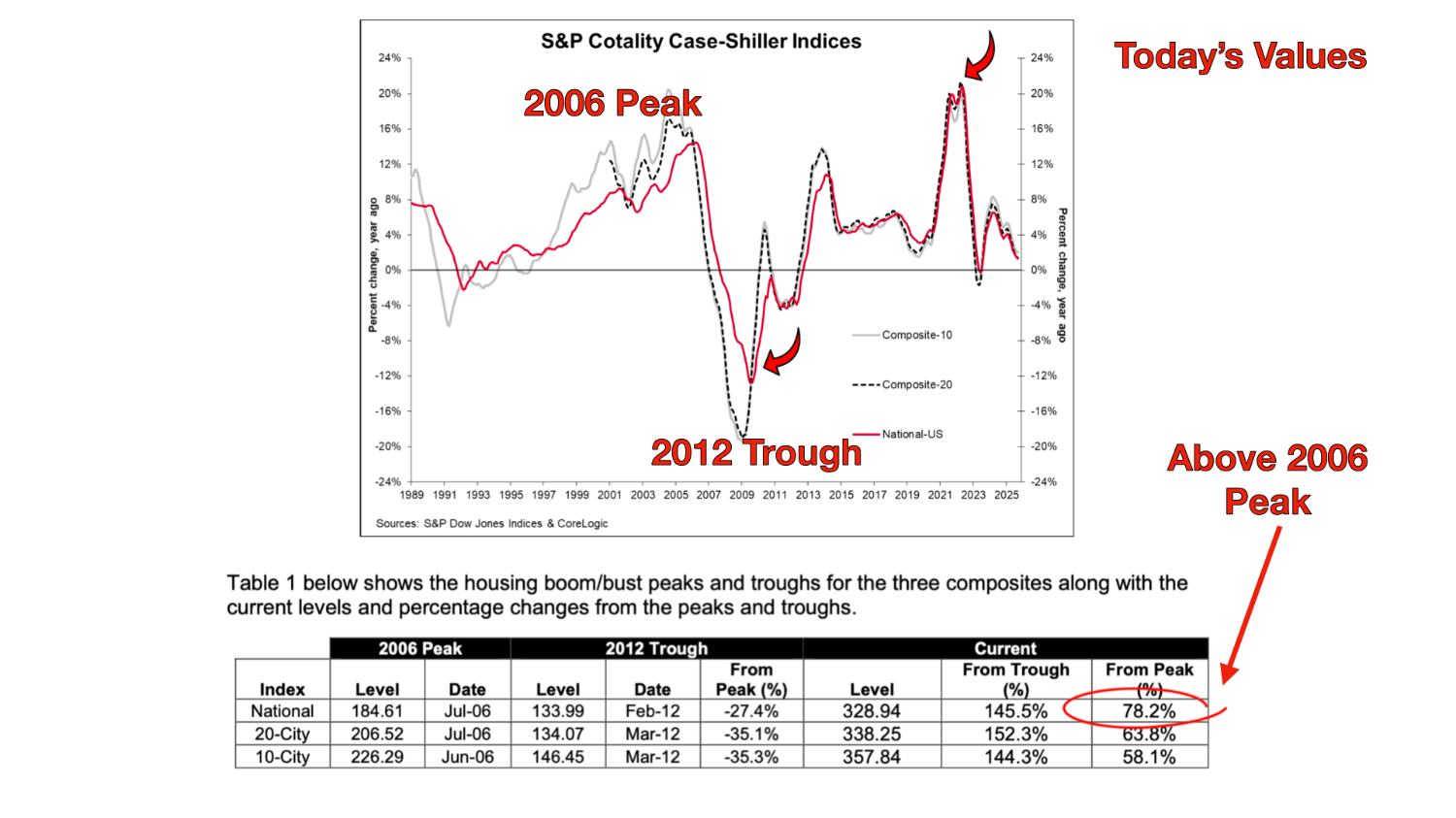

National Home Values Have Hit a New Value Peak in 2025

According to the Case-Shiller US Home Price Index, the value of the US Housing market has surpassed the high water mark that was set back in 2006, which was just prior to the previous Housing Crisis. Home Values are almost 79 % greater than they were during the previous 2006 Housing Boom and peak. The market has moved into uncharted territory. Remember that the Real Estate market works in cycles and the current market is artificially controlled at the moment, prompting many Industry Analysts, Economists and Experts to state that a massive correction (or reset) is already underway.

Housing Bubble 2.0: Boom, Bust, Crash & Crisis

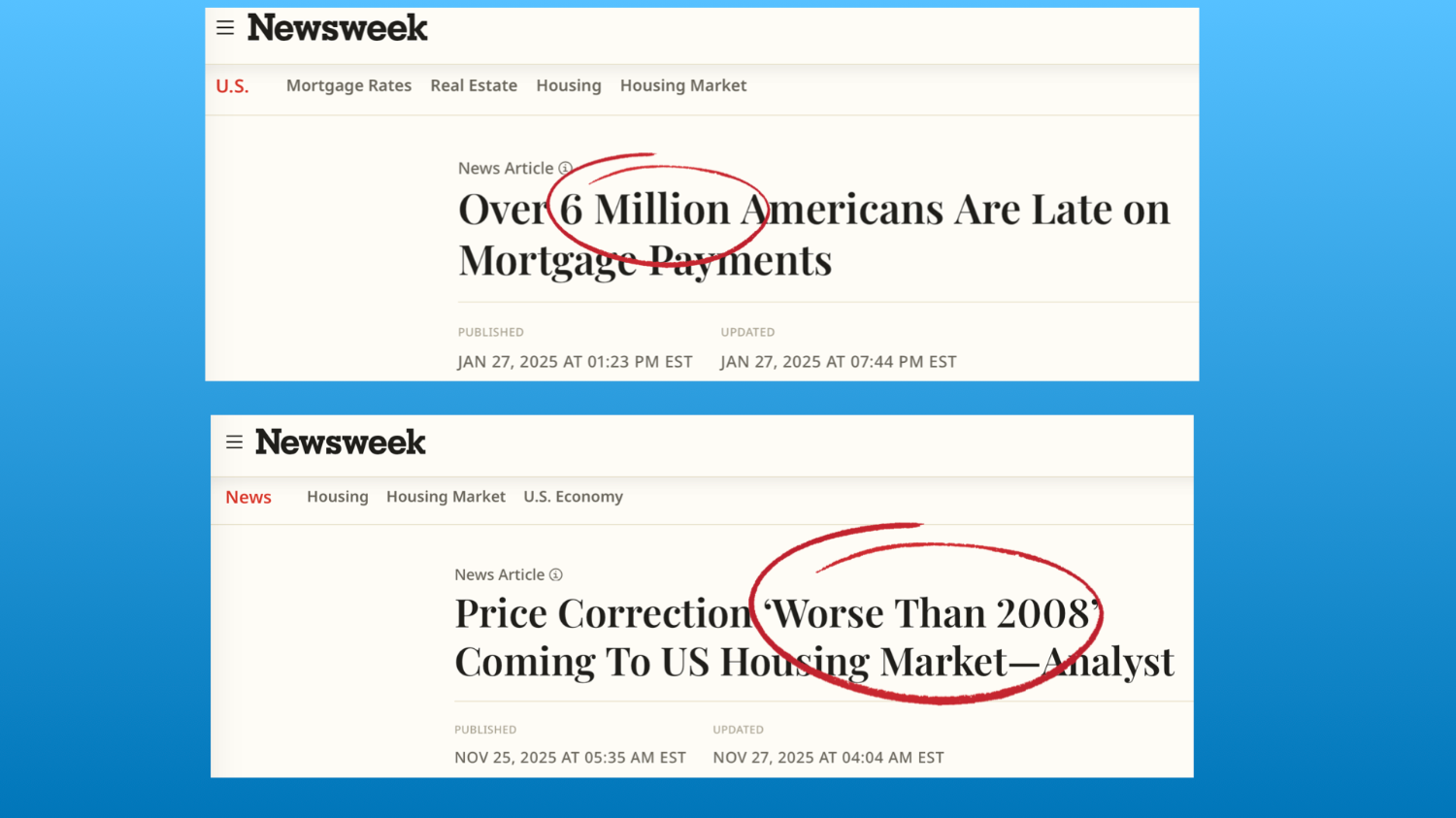

The previous Housing Bubble occurred well over a decade ago and it is happening once again. Property values are at all time highs and Mortgage Rates have increased significantly due to the FED's monetary policies. It is recipe for disaster. Mortgage Delinquencies are on the rise and the expectation among many Real Estate Analysts and Economists is a future wave of Foreclosures starting in 2026. In fact it has been reported in early 2025 that there are over 6 Million Homeowners who are not paying their Mortgage.

We are right at the cusp of another Housing Correction, Reset or Crash. With inflation on the rise, the lack of Housing Affordability and the future volume of Distressed Properties, Economists are openly stating that the Housing Market will decline in value as much as 50 %. Some are even stating that it will be "Worse Than 2008".

Housing Bubble 2.0: A Second Chance at a Once in a Lifetime Opportunity

As Real Estate Investors, We Need to Look at Different Options to Acquire and Purchase Property Without Paying High or Retail Prices. Let Us Show You How You Can Benefit from This Next Phase in the Housing Market Cycle with Seldom Used but Available Strategies That Will Deliver All the Low Priced Housing Inventory You Need to Jump Start Your Income, Build Equity and Increase Wealth.